The US stock market responded enthusiastically to President Trump’s re-election, with the S&P 500 index rising 6% from the eve of the 2024 election to its peak in mid-February. Since then, the majority of the gains have been wiped out, leaving US stocks in negative territory for 2025. (Source: Bloomberg, 5th March 2025). The selloff has been driven by the introduction of tariffs on Canadian, Mexican and Chinese goods, rising geopolitical risk and indications that the US economy may be losing some of its recent strong growth momentum.

Since Trump’s re-election, investors have been debating whether his administration would look to fully implement his more disruptive campaign pledges, including tariffs and deportations, or temper them. Based on the approach to tariffs, it appears that Trump is prepared to accept some economic discomfort to implement them in full, or close to it. Schroders’ economists have modelled what this could mean for the US and other economies in their “full Trump” scenario. This outcome is one of the reasons why we have maintained a significant allocation to gold and defensive assets in multi-asset portfolios and why we opted to trim equities earlier this year in many of our strategies.

Recent developments must be taken seriously, but knee-jerk reactions to headlines are rarely the right response, especially when President Trump is concerned. In some instances, the President may be limited or delayed in implementing his agenda, despite having the authority to introduce new policies in many areas. Some of his executive orders have already been challenged in court and blocked. In other areas, he still relies on Congress, where he has a slim majority in both houses and faces competing demands from different groups of supporters. History also shows that public opinion matters to presidents. A change for the worse in the economic backdrop may lead to a rethink if his policies are seen to be the cause.

An economic shock…

Global markets fell sharply on the 3rd and 4th March in response to news of tariffs on goods from China, Canada and Mexico. These levies have been on the cards for months, but many investors still believed they were being used as a bargaining tool and would not actually be implemented. As things stands, however, tariffs on Chinese goods have doubled to 20% and a new tariff of 25% will be levied on goods from Canada and Mexico – with a one-month delay for carmakers and goods covered under the US-Mexico-Canada trade agreement. The European Union is expected to face similar measures soon.

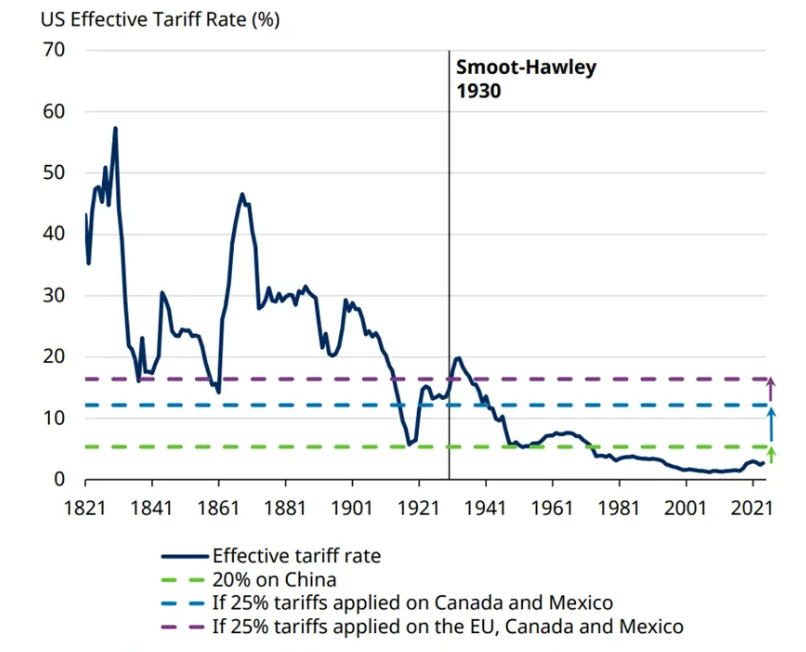

Schroders’ economists suggest that, if these tariffs remain permanently in place, they will lift the average tariff on US imports to 12% – from around 3% previously. Including the EU would take this to over 16%. The last time that US tariffs were this high was following the introduction of the Smoot-Hawley Tariff Act in 1930, which did little to help the US economy. We expect the impact of tariffs today to have a “stagflationary” impact on the US, increasing inflation and lowering GDP growth.

On their own, higher tariffs on Chinese goods would not have been a huge concern. American companies have coped with import duties on Chinese goods for years, and the impact can in many cases be limited by routing goods through other countries.

This will not be the case with Canada and Mexico. The sums involved are much larger. And many companies have built supply chains and assembly lines based on the frictionless trade allowed by previous trade agreements. Some will change the way they operate. Others will have to work out how much of the cost of tariffs they pass back to suppliers, on to consumers and how much they absorb themselves.

To the extent that tariffs feed through into higher consumer prices, they will make it more difficult for the Federal Reserve to lower interest rates. This fear of higher inflation is one factor cited in recent surveys showing weakening US consumer confidence. Given the importance of the consumer to the US economy, and corporate profits, this has been another factor behind the selloff in markets.

…and a changing world order

Tariffs are a key part of the Trump administration’s bigger plan to prioritise American interests in its dealings with other countries. This is causing upheaval in international relations.

The most significant development has been Trump’s decision to start negotiations over the future of Ukraine directly with Russia, without involving Ukraine or any European countries. This provocative approach may be intended to signal that the US no longer intends to be bound by the traditional alliances that have underpinned the international order for more than fifty years.

It is still unclear whether a cease fire in Ukraine will be reached. If it is, the economic impact is unlikely to be of the same magnitude as the invasion in 2022. Alternative supply lines have now been established for many of the commodities that came from Ukraine and it will be some time before the country can return to pre-war export levels.

America’s new approach to world affairs will have a broader economic impact, especially in Europe. In various speeches, the US administration has made clear that it expects Europe to bear more of the cost of its own defence and increase defence spending to 5% of GDP.

The call is being heeded. We have seen a significant rally in European defence stocks in anticipation higher spending. Germany’s Chancellor-in-waiting, Friedrich Merz, has said that his coalition government will exclude defence spending above 1% of GDP from Germany’s constitutional limits on borrowing. German government bonds fell by the most in over twenty years in response to the news. Higher defence spending will be more challenging for other European countries with less fiscal room for manoeuvre, such as the UK.

How are we positioned?

In many of our strategies, we trimmed our overall equity exposure earlier in the year, in part due to the high degree of uncertainty around US policy. While we anticipate further volatility, we remain comfortable with our current equity exposure. Geopolitical risk has increased, but equities still benefit from healthy corporate earnings and the continued expansion of the US economy.

The latest reporting season for US companies has been strong, and recent share price falls offer a more attractive entry point for investing in a number of high-quality businesses. On the economic front, US consumer confidence has weakened, but the fact that real incomes (i.e. after inflation) continue to rise should support consumer spending. Also, while the start of Trump’s second term has been dominated by news on tariffs and trade wars, tax cuts and deregulation remain on the agenda and would likely be viewed as more pro-growth by the market.

While we remain reasonably positive on the US economy, we are positioned for a move away from the market dynamics of the past two years, characterised by US market leadership and highly concentrated performance driven by the “Magnificent 7” technology stocks.*

We continue to see attractive opportunities in markets outside the US, including the UK and Japan, both of which have outperformed the US this year. We also have less exposure to the “Magnificent 7” technology stocks then the broader market across our strategies. While we are still excited by prospects for artificial intelligence and other technologies, we expect to see the benefits distributed more broadly in future and market concentration remains a risk.

Staying focused on the long term

Geopolitical shocks can cause shorter-term periods of volatility and lead to falls in the value of investments. However, this volatility can create the opportunity to invest at attractive levels. It is also important to remember that global equities have delivered impressive returns over the longer term, despite wars and conflicts along the way. As long-term investors, we believe it is important to remain invested through periods of uncertainty where possible, to benefit from this potential for strong returns.

Global equities have delivered impressive returns, despite geopolitical shocks

Total return of MSCI World Index indexed to 100 ($)

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.