Germany’s parliament has approved plans by incoming Chancellor Friedrich Merz to loosen borrowing limits. The law will exempt spending on defence and security from Germany’s strict debt rules. It also enables the creation of a €500 billion infrastructure fund.

Significant shift in fiscal spending

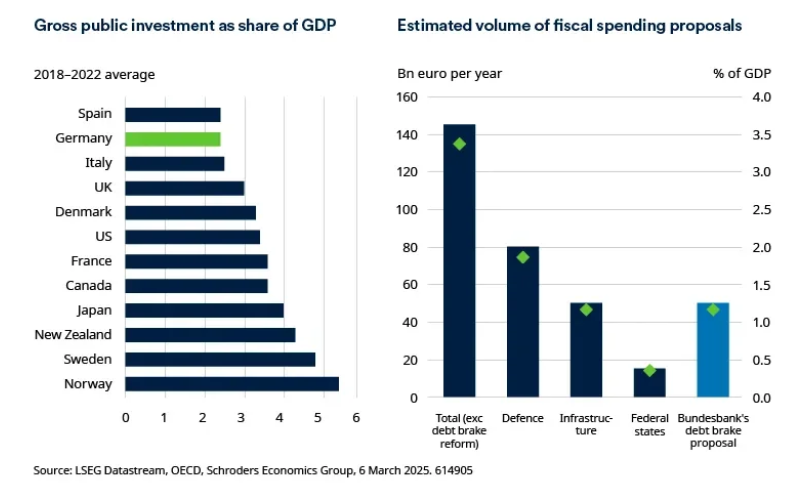

This represents a very important change to fiscal policy. Germany has traditionally been a laggard among high-income countries in terms of gross public investment, prioritising balanced budgets instead. The recent stimulus is set to increase the spending-to-GDP ratio by more than two percentage points per year.

Looking closer at the details of the proposal, defence expenditure exceeding 1% of GDP is exempt from the constitutional debt brake (the debt brake keeps the structural deficit below 0.35% of GDP).

EU leaders have recently highlighted their preference to tilt defence spending towards European producers rather than buying US weapons. While this is stimulative of economic growth, it could increase geopolitical tensions with the US and raises risks of a trade war between the two sides of the Atlantic.

The debt brake will also be changed to allow the federal states to incur new annual debt of 0.35% of GDP, whereas up until now they have not been allowed to take on new debt. And an infrastructure fund will be created to spend €500 billion over the next 12 years.

Impact on near-term growth

The new measures are not likely to significantly change the outlook for 2025 as it will take time for the spending to filter through the economy. However, for 2026 and 2027, the impact on growth could be significant, potentially adding one percentage point to growth per year over the next two years.

The shift in fiscal policy could also support growth via the confidence channel. Economic expectations have already started to rise following the fiscal stimulus announcement and the recent uptick in the manufacturing purchasing managers’ index (PMI) could signal the sector is turning a corner after several months of stagnation. (The manufacturing PMI is a measure of the prevailing direction of economic trends in manufacturing and is based on a monthly survey of supply chain managers).

There has been much excitement in markets about the prospect of these new spending plans being implemented. We think this excitement is justified, given the years of waiting for such measures, and it should prove to be reflationary.

Supply side reform still needed

However, even with this enormous stimulus, the German economy still faces significant challenges. The long-term impact on growth will depend heavily on whether the new stimulus includes supply-side reforms to address structural problems.

For growth to be higher in the medium to long term, we need to see the spending be accompanied by a pro-growth agenda. This would incentivise German businesses to invest domestically again, as well as attracting foreign investment.

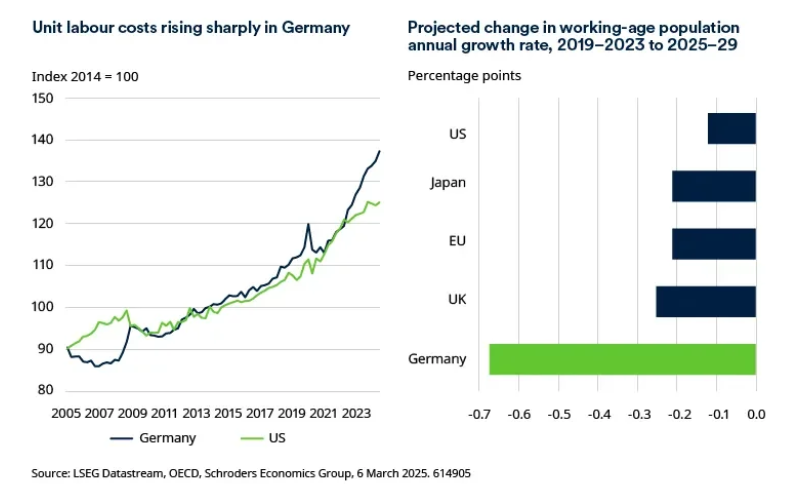

In particular, Germany needs to address the recent steep rise in unit labour costs. This has been mainly driven by a shrinking working-age population and declining productivity.

Another factor to take into consideration is how quickly the spending will come through. The infrastructure fund is large at €500 billion but this is set to be spent over a 12-year period. Capacity could become a blocker given limited capacity in the infrastructure sector (and in defence). Ramping up demand too quickly could therefore prove inflationary.

__________________________________________________________________________________________________________

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.