Our asset allocation decisions are based on a robust process that has proven itself through multiple market cycles. By design, this prevents us from making knee jerk decisions based on headlines and volatility. This is especially important at a time when US policy is becoming far less predictable, and subject to frequent reversals and revisions.

We are well prepared for today’s more challenging markets. In many of our strategies, we trimmed our overall equity exposure earlier in the year, in part due to the high degree of uncertainty around US policy. We also remain very focused on diversification, which has helped performance so far this year.

Within our equity allocation, our exposure to markets outside the US has reduced the impact of steeper falls in the US. In multi-asset portfolios, our defensive and diversifying assets have helped to protect capital.

Fundamentals continue to support equities

Recent economic developments in the US could lead to lower expectations for economic growth and corporate profits in 2025. Importantly, however, we expect both to continue to expand. Despite recent uncertainty, consumers continue to enjoy rising real wages, labour conditions remain supportive and US interest rates should fall slightly from current levels.

In many markets outside the US, the growth outlook is improving. We’re seeing a clear pivot towards higher fiscal spending in Europe and China, which should create a better backdrop for corporate profits, although risks still exist (e.g. tariffs).

Recent market falls have left valuations looking more attractive. This is offering a more attractive entry point to many high-quality businesses with strong underlying growth drivers that should not be derailed by policy shifts in Washington.

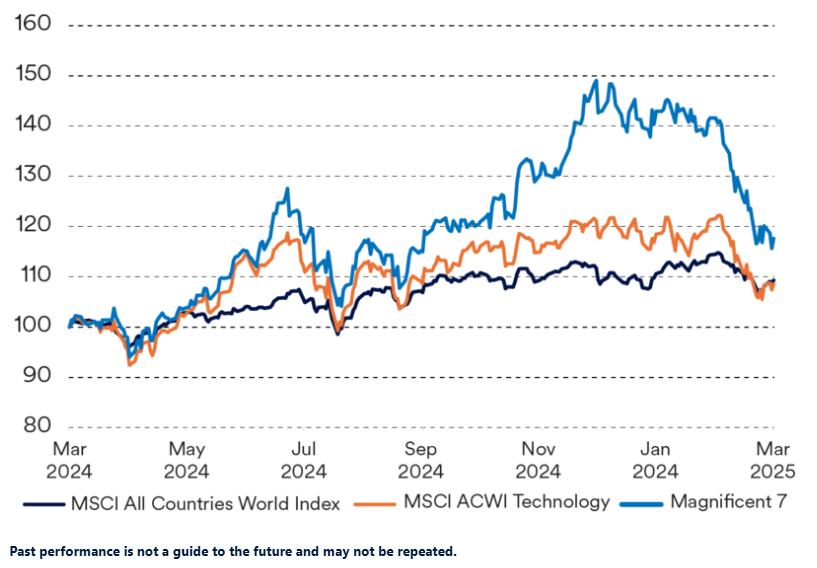

Technology outside the Magnificent 7 has been more resilient this year

Performance over the last 12 months, rebased to 100

Recent portfolio changes

We have been positioning for a move away from the market dynamics of the past two years, characterised by US market leadership and concentrated performance driven by the “Magnificent 7” technology stocks.1 We have accelerated this shift in 2025.

We have reduced our exposure to global funds, in favour of greater direct exposure to Europe and China. This has been achieved through the sale of allocations to the global mining and infrastructure sectors. Our expectation for any thematic investment is that it will outperform global equities in the medium term. While we continue to like both mining and infrastructure, we think changes in the macro-economic outlook will make this hurdle harder to meet.

We are also taking advantage of recent market weakness to add broad-based exposure to the global technology sector, looking beyond the “Magnificent 7” and the US. This reflects our view that the benefits of artificial intelligence (AI) may shift from “enablers” (those who provide AI infrastructure) to the “adopters” (those who develop real world uses for consumers and businesses). The recent launch of lower-cost AI models in France and China also suggests that established US technology leaders may face more global competition than previously anticipated.

1 Alphabet, Amazon, Apple, Microsoft, Meta, Nvidia, Tesla

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.