The global economy is growing at a reasonable pace, interest rates have most likely peaked, and corporate earnings are rising. All of these factors favour continued exposure to equity markets. After increasing our equity weighting at the beginning of the year, we have not actively added to positions, however. Valuations look relatively high, especially in the US, and sentiment remains very optimistic.

Within our higher-risk portfolios we have initiated a position in mining equities. This is another way of expressing our view that commodities are a compelling long-term investment theme, while also taking advantage of the current attractive valuation of miners. This position has been funded through the sale of exposure to S&P 500 and does not change our overall asset allocation.

Will other lagging markets play catch up?

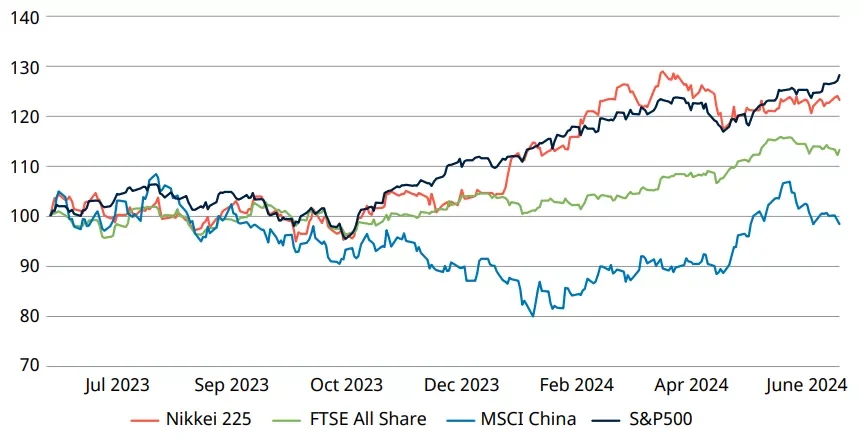

We spoke about Japan’s revival last quarter and remain comfortable with our allocation. There are two other markets that have also suffered relatively poor long-term performance and could enjoy a more meaningful rebound.

The UK is one. The general election comes at an interesting juncture for its equity markets, which are at the highest level in over 20 years. Valuations remain attractive, interest rates are likely to be cut, and we may see greater political stability after the election. As a result, UK equities could start to look more attractive to domestic and international investors. The latter often characterise the UK market as a “retirement home,” which to my mind is an unfair analogy. We are currently overweight UK stocks and are monitoring developments closely.

Chinese equities have also seen a modest turnaround this year. As well as some signs of economic recovery, investors have been mildly encouraged by the latest measures to revitalise the property market, including a fund created by China’s central bank to purchase unsold property for use as social housing. The key question for investors is whether it leads to a sustainable improvement in consumer confidence, although it has to be acknowledged that the property sector remains a significant “dragging anchor” to Chinese economic growth.

UK and China have lagged the US and Japan over the past year

Performance of national markets (total return, local currency, rebased to 100)

Past performance is not a guide to future performance and may not be repeated.

Source: Cazenove Capital, LSEG Workspace

Reducing credit risk and trimming gold

Concern about inflation has weighed on fixed income markets this year. However, government bond yields remain comfortably below the highs of the last two years. While the price performance has not been exciting, bonds continue to offer attractive levels of income. They can also help to protect portfolios in the event of a slowdown or shocks, though as we saw in 2022 this is not always the case.

Corporate bonds have performed better than government bonds as investors take on more risk and credit spreads (the additional return for lending to companies compared to governments) narrow. We have taken advantage of this trend to cut our exposure to higher risk corporate bonds in favour of lower risk corporate and government bonds, which look more attractively valued.

We have also trimmed our exposure to gold. The precious metal has performed better than we would have expected given the interest rate environment as central banks increase allocations. This is not necessarily a sustainable trend.

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.