Ever since President Trump’s re-election, investors have been debating whether his administration would look to fully implement his more disruptive campaign pledges, such as tariffs and deportation, or temper them. To their dismay, it appears that Trump is willing to subject America (and the global economy) to significant upheaval to implement them in full, or close to it. It is evident in the 25% tariff imposed on imports from Canada and Mexico, as well as a somewhat chaotic approach to cutting federal government jobs.

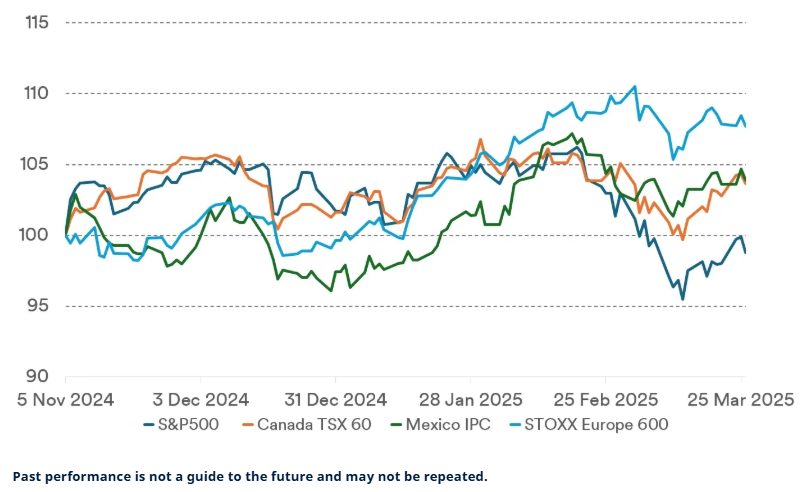

US equities fell 10% from their peak in mid-February to mid-March. Other markets also suffered, but to a lesser extent. This suggests the sell-off may reflect anxiety around the direction of US policymaking, more than the actual impact of measures announced so far.

Stocks in Europe (and Canada and Mexico) have outperformed the US since the election

Key regional / national equity indices, rebased to 100

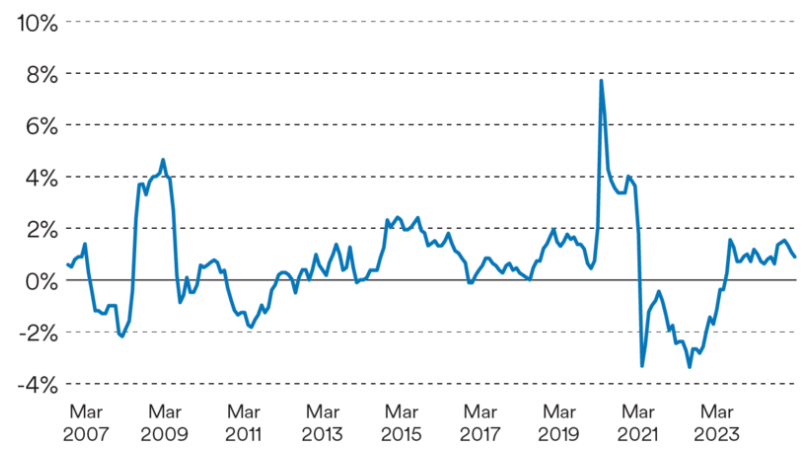

The American economy started the year with considerable momentum behind it. This is still apparent in the data: US incomes continue to rise, even after adjusting for inflation, and the economy is adding jobs at a reasonable pace. But there are signs that business sentiment and consumer confidence is weakening. After two years of high inflation, surveys suggest that consumers are particularly worried about its return; if this concern endures, they could start cutting spending. Economists have been trimming their US growth forecasts and analysts their earnings forecasts for US companies.

The impact of tariffs is significant but should not (on its own) derail America’s economy. Trade accounts for a much smaller share of US output than in other countries: 25% compared to the 63% average for high income countries, based on World Bank data for 2023. Consumption represents a much larger share of GDP and consumers remain in a relatively healthy position. We have also yet to see the benefit of initiatives such as tax cuts and deregulation, which could help to restore confidence.

US incomes continue to rise, supporting consumer spending

Annual change in US average hourly wages, adjusted for inflation

An economic shock…

If the tariffs announced on Canada, Mexico and China remain in place, they will lift the average tariff on US imports to 12%, from around 3% previously. Including the EU would take this to over 16%, a level not seen since the 1930s. In the short term, Schroders’ economists estimate that the tariffs announced to date could add 1% to US inflation (compared to their latest forecast for 2025 of 3.1%) and knock 0.5% from growth (compared to the previous forecast of 2.5%). The longer-term impact remains unclear.

Tariffs on America’s closest neighbours, and largest trading partners, will be more painful than import duties on other parts of the world. Goods from or routed through Canada and Mexico cannot easily be routed through other countries, as has often been the case with Chinese exports. Companies have also built supply chains based on the frictionless trade allowed under previous trade agreements. They will have to change the way they operate, pass costs on or accept lower margins.

…amid a changing world order

Tariffs are just one part of the Trump administration’s larger reset of America’s relationship with the rest of the world. Recent dealings with Europe have made it very clear that the US no longer intends to be bound by the traditional alliances that have underpinned the international order in recent decades.

Geopolitical shifts don’t always have obvious market consequences, but recent developments will:European leaders have quickly recognised the need for higher defence spending. For Germany, this is likely to take the form of a debt-funded fiscal stimulus package that should revive the economy after years of budgetary restraint and weak growth. In countries with less fiscal room for manoeuvre, such as the UK, it may require painful cuts to welfare spending. More encouragingly, it may revitalise cooperation on defence in Europe – including the UK – as the continent finds a sense of purpose that has been missing for many years.

What about China?

The US administration has made many speeches about, or perhaps more accurately at, Europe. It has been quieter on China. At our Investment Seminar earlier this year, Sir Sebastian Wood, former British ambassador to China, suggested that we would see a continuation of “wary coexistence” between the US and China under Trump.

There are grounds for optimism. US presidents have in the past frustrated Chinese leaders with their talk of a contest between autocracy and democracy. The Trump administration is less focused on values (putting it diplomatically), potentially opening space for dialogue.

But fundamental sources of tension remain, as the US faces a rival in the global pecking order for the first time in decades. The two countries are competing for the domination of new industries such as AI, control of global resources and influence around the world.

In this context, the success of a Chinese AI model, DeepSeek, takes on new importance. Along with other low-cost AI rivals (such as France’s Le Chat), it has called into question America’s dominance of the rapidly evolving AI industry, something that was taken for granted just a few months ago. This will have implications for markets.

AI: does the winner take it all or do we all win?

Technology companies were not immune from last month’s sell-off. As well as their optimism about “Trumponomics”, investors may also have shed some of their more unrealistic expectations about AI. Many more are now asking whether the pace and extent of AI adoption will justify the huge spending on infrastructure by the largest technology companies. 2025 should bring further clarity about the industry’s economics.

Over the past 40 years, the emergence of “winner take all” industry structures in technology has been a key trend in financial markets. This has led to incredible success for a small number of technology companies – whether in PC software (Microsoft), internet search (Alphabet) or online retail (Amazon). Time and again, we’ve seen market share and profits going primarily to one company.

Will this pattern be repeated in AI? The huge investments in chips and datacentres announced by the biggest technology companies suggest they believe it will. But this is far from assured. Many of the most successful technology companies of recent years have benefited from “network effects.” If everyone else is on Facebook or LinkedIn, you may have little choice but to join them. That is not obviously the case for AI: I like ChatGPT, but perhaps you prefer DeepSeek or Le Chat?

The need for an active approach

If it turns out that AI is not in fact a “winner takes all” technology, we could see the “Magnificent 7’s” dominance of US markets coming to an end. This is a shift we have been expecting for some time.

Amid the volatility of the first quarter, we may have seen a turning point in another long-running market trend: the outperformance of US stock markets. At the start of the year, investors heard a great deal about “US exceptionalism.” It has not aged well. In the three months to mid-March, 40 of the 47 stock markets represented in the MSCI All Countries World Index outperformed the US. It is too soon to say whether this marks the start of a more enduring shift, but we are open to the idea.

In this environment, a nimble and active approach will be essential, as Schroders’ new Group CEO Richard Oldfield argues. In-depth analysis and research will always underpin our investment decisions, whether they are implemented through ETFs, actively-managed funds or individual stocks or bonds.

____________________________________________________________________________________________________________

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.