Welcome to the quarterly Green Macro Newsletter, where we present recent news, internal and external research on topics covering the economic impact of climate change, green energy transition, and natural capital.

In this newsletter we focus on recent developments in carbon pricing policies, electric vehicle tariffs, and look at the possible impacts of the Trump administration’s decision to withdraw from the Paris Climate Agreement, again.

In the news

The EU CBAM is encouraging the EU’s trade partners to adopt carbon pricing policies

The EU Carbon Border Adjustment Mechanism (CBAM) is a tariff that targets “carbon leakage” in offshore production of imported goods, applying a carbon price to imported goods that is equivalent to the carbon price applied to goods manufactured in the EU. The CBAM will start to be implemented in January 2026, but it is already having the intended effect of spreading carbon pricing to other countries.

Several countries are developing their own domestic carbon pricing scheme in order to retain revenues domestically by reducing their ‘CBAM bill’. In December, Brazil passed a law to cap greenhouse gas emissions from companies and set up a nationwide system to trade carbon credits. The legislation creates the Brazilian emissions trading system (SBCE) and stipulates that companies with over 25,000 metric tonnes/yr of emissions will be subject to the cap-and-trade system. According to a study by think tank ICC Brasil, Brazil has the potential to generate up to $100bn in revenues from the carbon market by 2030.

The CBAM is acting as a key driver for adopting carbon pricing schemes in some Asian countries too, including Singapore, Taiwan, and Japan. The Japanese industry ministry has stated that companies that emit more than 100,000 tons of carbon dioxide annually will be required to participate in the government’s carbon emissions trading system, set to take effect in fiscal 2026. The program is expected to apply to between 300 and 400 companies, mainly in the steel, electricity, aviation, logistics, and food manufacturing sectors.

Our view: We believe that we will see more carbon pricing schemes implemented globally, as other developed countries look to mirror the EU and adopt their own carbon border tax. The UK Government has recently confirmed that it will implement a CBAM by 2027, applying a charge on the carbon emissions embodied in imports from key sectors, including aluminium, cement, fertilisers, hydrogen, and iron and steel sectors. This formation of a “carbon club” means that additional pressure will be exerted on key exporting countries to raise their domestic carbon pricing schemes. Carbon taxes and pricing systems provide funds for governments while encouraging companies to adopt low-carbon technologies and innovate towards greener production methods. Rising carbon prices are likely to increase inflationary pressures, especially for those countries heavily reliant on fossil fuels as a source of energy production.

The EU imposes tariffs on Chinese electric vehicle (EV) imports

The European Commission concluded its anti-subsidy investigation by imposing definitive tariffs on imports of battery electric vehicles (BEVs) from China, effective for a period of five years. This investigation was prompted by a dramatic increase in trade flows. The EU accounts for almost 40% of Chinese exports of EVs and the region represents their top destination. Chinese EV exports to the region rose 37% year-on-year in 2023 to $13bn. Findings revealed that the BEV value chain in China is significantly supported by state subsidies, which distorts competition and poses a potential threat to the EU’s automotive industry. The countervailing duties imposed vary according to car brands, ranging from 7.8% for Tesla to 35.3% for SAIC, reflecting the differing levels of subsidy applicable to each manufacturer.

Our view: By imposing these tariffs, the European Commission intends to establish a fair competitive environment for both Chinese and EU car manufacturers. However, analysis by Rhodium group indicates that most Chinese producers are likely capable of absorbing these costs to maintain their market share. A number of Chinese EV models may still benefit from a strong profit premium in the EU, as more substantial tariffs of 55% on competitive brands like BYD would be necessary to make exports financially unattractive.

The move is also not likely to bolster the European car industry. Europe’s battery supply chain is facing structural pressures, such as lack of innovation and high energy prices. While protective tariffs might offer short-term relief, they do not address the root causes of the growing competitiveness gap between Europe and China. While some retaliatory tariffs may arise, we do not expect a significant escalation in trade policy as the EU remains a critical market for Chinese exports.

Trump withdraws from the Paris Agreement again

On his first day back as president, Trump signed an executive order directing the US to exit the Paris Agreement on global warming. This marked the second time Trump had taken this step, having previously announced the US withdrawal from the accord during his first term in 2017. Trump also issued another order that directs federal agencies to pause disbursements of certain funds under the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA) of 2021. Agencies must suspend loans, and other financial mechanisms, including those supporting electric vehicle infrastructure, until they complete a 90-day review to ensure alignment with the administration’s energy policy.

Our view: Trump’s policies will once again undermine the US commitment to global climate efforts and could potentially create some headwinds for the fight against climate change. However, the affordability and efficiency of renewable energy sources will keep pushing the move towards a low-carbon economy. Market forces and actions at state level will continue to play a critical role in supporting green energy expansion. Wind and solar energy are poised to keep adding power capacity as their prices are now competitive with fossil fuels.

Los Angeles wildfires are set to be the costliest climate disaster in US history

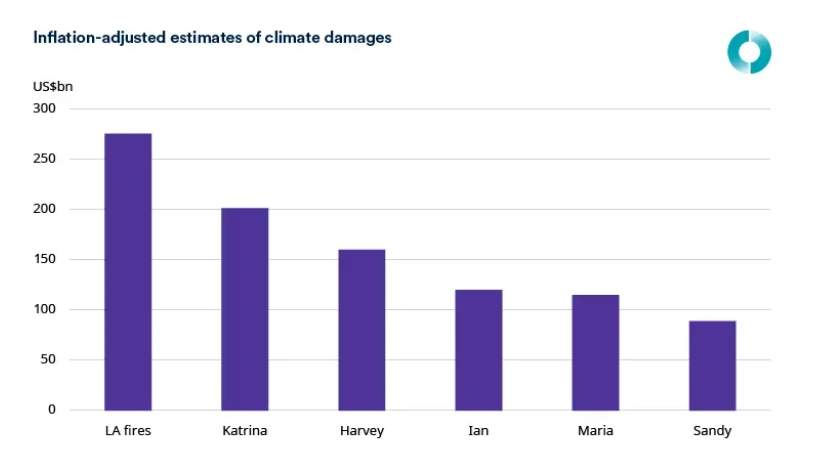

Recent estimates of the economic damages from the wildfires in Los Angeles suggest that they are expected to be the most expensive climate disaster in US history, with costs exceeding those inflicted by Hurricane Katrina in 2005 by more than $50 billion.

Inflation-adjusted estimates of climate damages

Source: AccuWeather, NOOA, Schroders Economics Group. January 2025.

Our view: As the wildfires in Los Angeles have primarily affected residential areas, without disrupting business operations and employment, the impact on GDP is expected to be minimal. However, the consequences for households should not be overlooked. Increasingly frequent and severe weather events have led to a rise in insurance claims. In several states, insurers have reported declining profits on homeowners’ insurance due to significant losses from wildfires, floods, and storms. In response to these losses, many insurers have raised premiums, limited coverage, dropped customers, and even withdrawn entirely from some markets. This trend has been observed in California, where wildfires are common, as well as in Florida and Louisiana due to flood risks. As a result, higher insurance rates are causing financial strain for many homeowners. Rising housing costs are likely to reduce household spending while exerting downward pressure on house prices in markets that are particularly vulnerable to climate events.

Battery storage is on the run

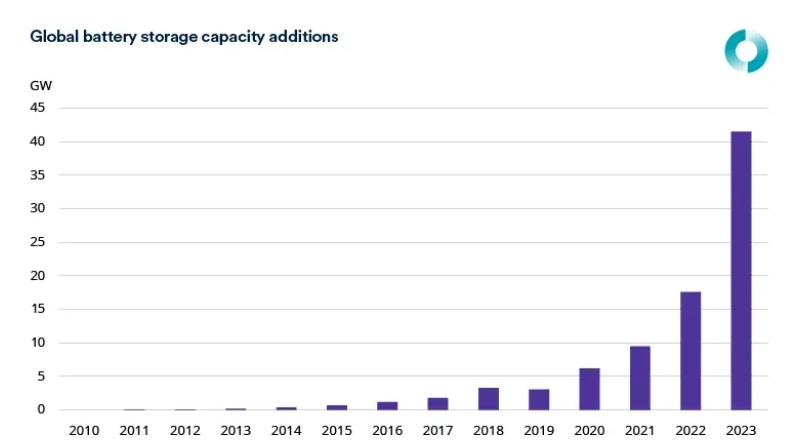

Over the past decade, global installed battery storage capacity has risen dramatically, increasing from approximately 1 gigawatt (GW) in 2013 to over 85 GW in 2023. Notably, more than 40 GW were added in 2023 alone, more than doubling the additions seen in 2022.

Global battery storage capacity additions

Source: IEA, Schroders Economics Group, January 2025

China has emerged as the leading market for battery storage in recent years, with its share of global annual additions increasing from around 20% in 2019 to 55% in 2023. Capacity additions surged to 23 GW in 2023, tripling from previous years. Approximately two-thirds of this new capacity was utility-scale, driven primarily by provincial mandates requiring that new solar PV or wind power projects be paired with energy storage.

The US stands as the second-largest market for battery storage, with additions reaching over 8 GW in 2023. Nearly 90% of the additional capacity came from utility-scale projects, with states like California and Texas leading the deployment efforts. This growth has been mainly supported by investment tax credit introduced under the Inflation Reduction Act.

Our view: Batteries are a key component of the global energy system today and are poised to play a critical role in facilitating secure and clean energy transitions. In the power sector, storage improves energy security by supporting grid stability, meeting peak loads, and facilitating the integration of increasing shares of variable renewable energy sources while also reducing fossil fuel demand across multiple sectors. According to the IEA, from 2010 to 2023, their average costs decreased by 90%, making them a competitive source of flexibility in the power sector. A surge in manufacturing capacity is contributing to the decline in prices, further supporting the goal of tripling the installed capacity of renewables globally.

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.