To listen to this article as an AI-generated podcast, click below. This recording was created in minutes using NotebookLM, an AI-assistant powered by Google’s Gemini 1.5 Pro model. The voices were generated by AI and are not those of the authors.

Companies in bold are held within Cazenove Capital’s direct equity portfolios. References to specific companies are for illustrative purposes and are not recommendations to buy or sell.

As 2025 gets underway, the parallels with the past are uncanny. The United States has a new president, but he is one we have seen before. In a replay of the market moves seen after Trump’s win in 2016, US equities rallied and government bonds sold off amid optimism about his proposed economic policies. Consensus forecasts for US GDP growth in 2025 are 2.1%, similar to the 2.2% forecast in Trump’s first year as president in 2017 (Source: Bloomberg). The US economy remains strong, leading the world at a time when others are stumbling, instead of falling into recession as many predicted a year ago. And, as at the start of 2024, the S&P 500 has gained more than 20% in the previous calendar year. It feels like we’ve seen this movie before.

More worryingly, many of today’s global challenges also come with echoes of the past. Much like the Cold War era, US leadership is being challenged. Conflicts in Ukraine and the Middle East, as well as tensions with China, threaten global disruption. Populist movements are gaining momentum, fuelling a potential reversal of free-trade policies, while inflation and rates are significantly higher than during Trump’s first term.

US exceptionalism

President Trump takes office for a second time with the US in a strong position. Former Treasury Secretary Larry Summers caught the spirit of the times with his recent quip that “Europe is like a museum, Japan a nursing home and China a jail”, saying he would “rather be playing America’s hand than any other country in the world”.

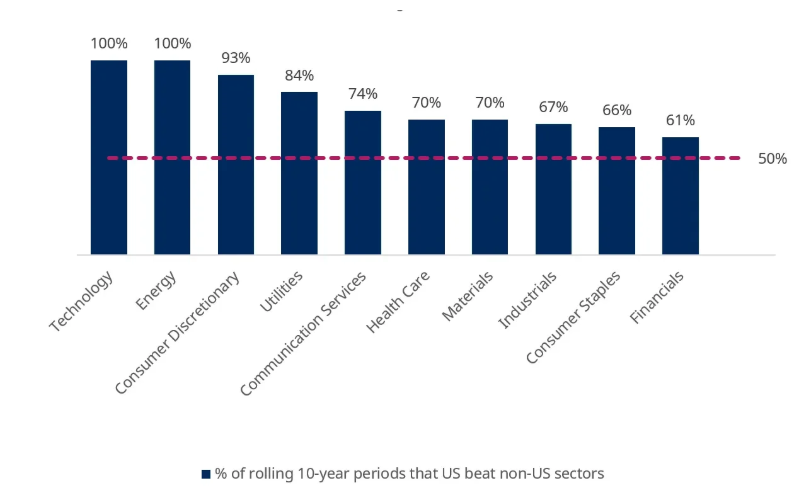

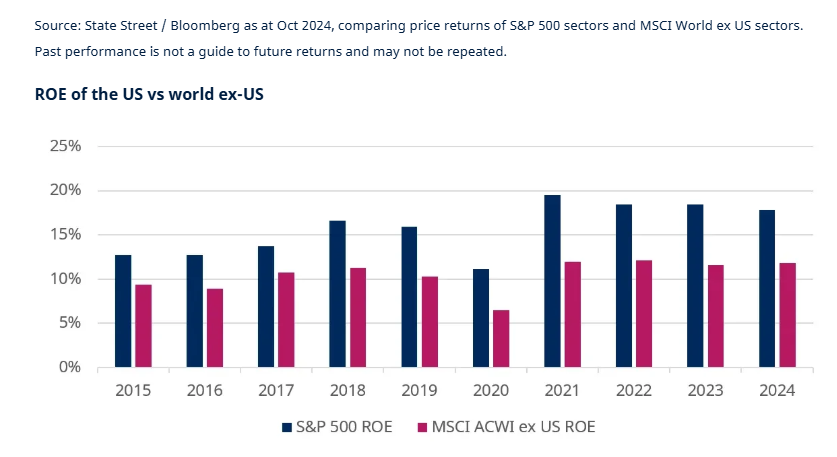

America’s outperformance is not just down to the effect of its largest companies. In almost every sector, the US has outperformed international counterparts – and this has been the case for most of the last decade (see first chart, below). Investors now routinely talk about “US exceptionalism,” often attributing it to a combination of low-cost domestic energy, an entrepreneurial culture and deep capital markets. In practical terms, all of this means that American workers are more productive than their international rivals: US output per person is now 30% higher than in Europe and 60% higher than Japan. [Source: The Economist; 17 October 2024]. As a result, American companies tend to generate a higher return on equity (ROE) than their counterparts elsewhere in the world (second chart below).

US sectors have done better than non-US sectors more than 50% of the time since 2010

Markets are assuming that Trump can turbocharge America’s impressive performance in the short term – and perhaps he will. However, Trump’s policy agenda seeks to significantly reshape the US economy. The idea that this can be accomplished without US workers or consumers bearing any of the cost strikes us as overoptimistic. We should also not get carried away with the idea of US supremacy. Things change and there is no guarantee that the next Nvidia or Apple will be found on US shores. In any case, we are less concerned about where a company happens to be listed and more about what makes the company the best in its field for the long term – well beyond the term of a US government.

Below, we explore five of the key traits that help us identify leading businesses that can thrive today and into the future.

1. Build an ecosystem

Historically, scale has been an impediment to growth. That’s not the case with the biggest US tech companies, where the big only seem to be getting bigger. Historically, the law of large numbers has meant that the largest organisations inevitably see a decline in their rate of growth. It is almost impossible for Meta to double its customer base over the next decade when it already has 3.6 billion users across its platforms. But statistical theory hasn’t yet become an obstacle for the biggest US tech companies. While their innovation budgets are vast, the sums involved remain relatively small compared to their annual profits. This is the ecosystem that keeps the growth engine firing. And successful innovations can create new markets that perhaps didn’t even exist before. Amazon’s fulfilment centres and Google’s Waymo autonomous cars are testament to that.

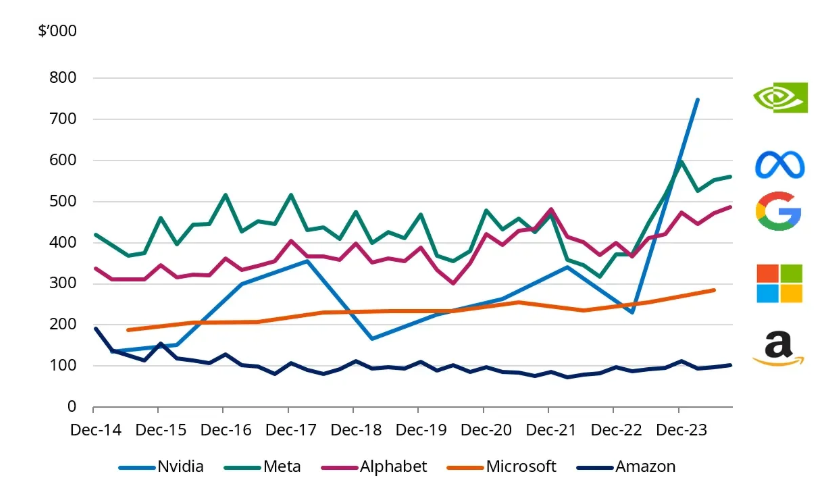

Since Meta’s headcount reductions in 2023, revenues have gained 25%, equivalent to 50% per employee. The effect on margin and earnings, with a boost on the valuation, has driven a 4x return in the stock price. Nvidia’s video gaming chip success allowed it to expand into AI with little additional outlay. They had to hire a few more engineers but revenues soared 3x on a per head basis. [Source: Meta and Nvidia 2024 annual reports].

Sales per employee for the ‘Fantastic 5’

These largest companies are ecosystems of efficiency. And beyond their own ecosystems, there is a broader network of firms that benefit from them, notably those that supply the infrastructure critical to their success.

All along the semiconductor value chain, the share of AI infrastructure spending is broadening out away from Nvidia alone. Take Broadcom for example. The company recently announced that it will be tying up with Apple to provide their networking technologies needed for AI processing. This has potential to quadruple its AI-related sales over the next three to five years. Meanwhile, Apple will be using TSMC’s most advanced manufacturing process to build their chips. The fact that Apple has chosen not to use Nvidia likely speaks to the tight supply of their newest Blackwell chip, and Apple has most often preferred to build their own equipment in house.

For this reason, and given we are seeing other industries look to source AI chips from other suppliers, we have been reducing positions in Nvidia and have recently added a new holding in Cadence Design Systems, whose silicon wafer design software provides the blueprint for its customers to engineer their own chips. Nvidia would not exist without it. We think their cadence can pick up over the next five years with very little competition in their way.

Ultimately, companies that fail to embrace technology run the risk of being disrupted by more nimble players using productivity-enhancing software to deliver better customer outcomes. RELX, for example, has been on a long journey embracing a tech-first mindset. As a global provider of information and analytics, it has spent years transferring its data from analogue to digital and increased its pricing and margins as a result. Its AI tools enable customers across legal, scientific and medical sectors to make more informed decisions.

“Think of every company as a technology company. They either make it or they use it. If they don’t use it, they are going to be at a competitive disadvantage.”

Dr Ed Yardeni, President of Yardeni Research

2. Innovation, innovation, innovation

Innovation is not something only tech companies can do. Energy security, the reshoring of supply chains and data centres are driving years of demand for a range of capital equipment.

As the world continues to increase its electricity consumption, companies like Emerson Electric are well positioned to serve an expanding market. Smart metering and renewable energy solutions provide a strong tailwind for company sales. It is highly innovative and has an increasing suite of products serving the rapidly growing automation market.

We could also look at Spirax Group’s electric heating systems business. This segment is focused on solving heating challenges for customers with proven low-voltage technologies that deliver decarbonisation through electrification. Alongside this mission critical line of business, the company have now expanded to medium-voltage solutions – a “game changing innovation” that allows for the delivery of 5 to 10 times more heating power at much lower cost. Whereas historically electric process heating was relegated to only 5% of the total industrial heating landscape, with this new technology, Spirax can expand into serving applications in the remaining 95%. [Source: Spirax Capital Markets presentation, October 2024].

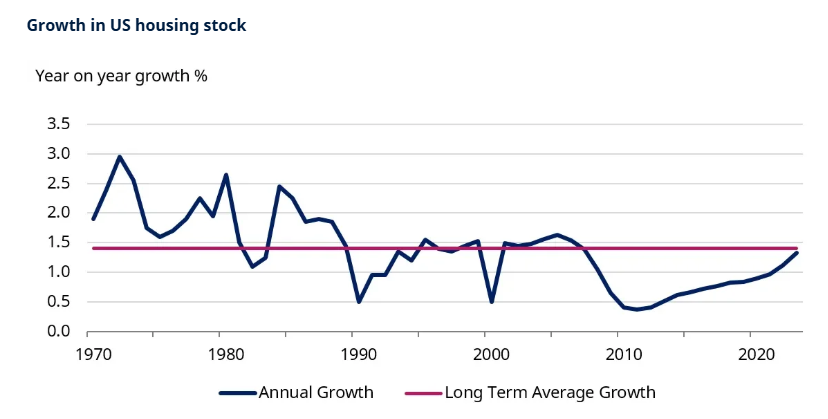

Owens Corning, one of the newest holdings in our portfolios, supplies the US building industry with products from roofing to glass–fibre reinforcements for both residential property and commercial infrastructure. A large proportion of sales are related to repair and maintenance, giving some shelter from cyclical forces. And with more than 140 new or improved products launched over the past 3 years, we view Owens Corning as an innovative materials company plugged into some key secular trends, such as labour and energy efficiency. [Source: Owens Corning Investor Presentation, August 2024].

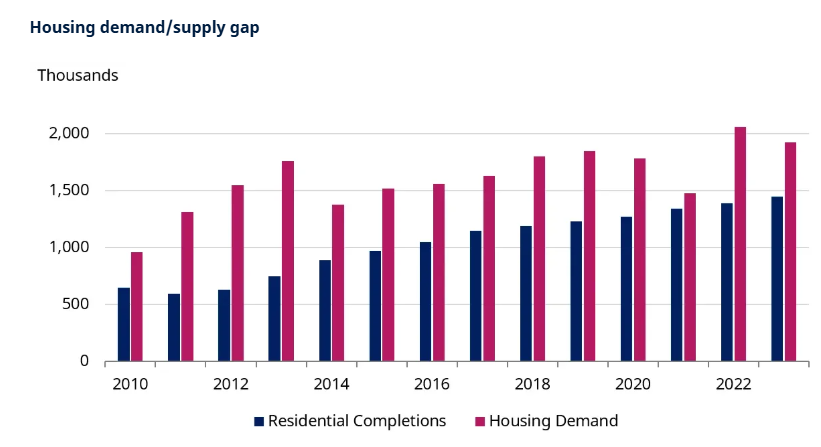

While these trends are long term in nature, they are gaining attention as Trump has stated that he intends to boost housing supply across the US in recognition that the supply of new homes has not kept up with demand since the financial crisis of 2008.

3. Stay on target

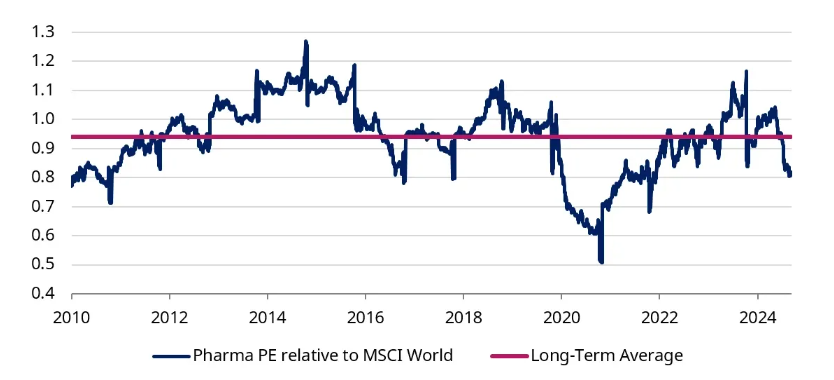

We love businesses that love what they do. And irrespective of any short-term anti-vaccine rhetoric, we have long held a preference for cash generative, innovative healthcare in our portfolios. Despite these properties and ongoing advancements across data and drug discovery, pharmaceutical stocks, which are amongst the highest quality companies in our universe, appear undervalued relative to the broader market.

Pharmaceutical sector Price Earnings (PE) relative to MSCI World through time

We have found some exciting opportunities in this sector. Take AstraZenca, for example. Its shares have been under pressure due to concerns about a contained investigation in China. Astra’s pipeline prospects are unaffected, however. To our minds, there are a raft of catalysts that could unlock upside value in 2025. Its prostate cancer drug, Truqap, could unleash over $1bn of sales, according to analyst forecasts, while readouts are expected for drugs targeting earlier-stage breast cancer, lung cancer and asthma, in addition to data from its obesity franchise.

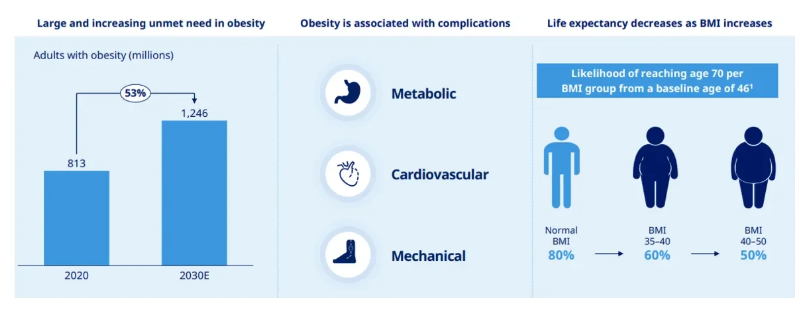

As for the companies at the forefront of the obesity drugs market, Eli Lilly and Novo Nordisk are maintaining their discipline and first-mover advantage in a growing market. And to stay ahead, both have been actively pursuing acquisitions and partnerships, as well as boosting their Research & Development (R&D) on cardiometabolic diseases and obesity. Over the last two years Lilly has increased its R&D budget by 50% to $11bn, which at 25% of sales makes it one of the largest innovators of its pharma peers. Eli Lilly and Novo Nordisk each have 11 new molecules in development for obesity, where the opportunities remain substantial. [Source: Eli Lilly Q3 Earnings Presentation, October 2024, biospace.com and Novo Nordisk website].

A large and unmet need in treating obesity

In October 2024, Eli Lilly announced a $4.5 billion investment to build the Lilly Medicine Foundry, a first-of-its-kind facility that will combine research and development with manufacturing and technology to innovate new production methods and scale global access to their therapies. Scheduled to open in late 2027, the build out will have knock on benefits to Indiana’s roads, water and electricity networks and once fully operational will add 400 full-time jobs for highly skilled workers including engineers, scientists, operations personnel and lab technicians.

“As we accelerate our work to discover new medicines for the toughest diseases, we’re continuing to invest in state-of-the-art infrastructure to support our growing pipeline”

4. Defend what matters most

Significant infrastructure investments like Lilly’s showcase that dominant companies will invest not only to advance their operations, but also protect what they have built.

It is a similar story to that of the biggest technology companies. Amazon, Google and Microsoft continue to build out the infrastructure necessary to accommodate the massive volumes of data storage and computing power required by AI.

Tools like ChatGPT run on large language models hosted on thousands of servers in massive data centres. These data centres require cooling systems, as well as a power infrastructure consisting of transformers, generators and transmission lines.

Most of these elements require copper. The construction of a $500 million Microsoft data centre near Chicago required 2,177 tons of copper, for example, and miners like Freeport-McMoRan and Antofagasta dominate copper mining, an increasingly rare mineral in heavy demand in several industries. Similarly, Schneider Electric, whose products help make commercial buildings more energy efficient, projects 7% to 10% annualised growth through 2027.

Regardless of the industry, we look for companies with few competitors and strong moats — that is high barriers to entry, irreplaceable assets and growing demand. Defending a leading position requires the right product lineup, refinement of the business model, and a strong management team. Looking for more examples across industries, Illinois Tool Works has a hold on the heavy industrial equipment segment, Ball Corp has a grip on the production of aluminium cans, the ultimate recycled material, while Home Depot is one of only two dominant players in the highly fragmented home improvement market.

“You have tremendous potential in an untapped balance sheet and equity positions in homes.”

Ted Decker, CEO Home Depot, February 2024

5. Embrace emerging opportunities

We have written previously about the select opportunities in emerging markets, with a particular focus on China. But China is not the only fast-growing investable economy.

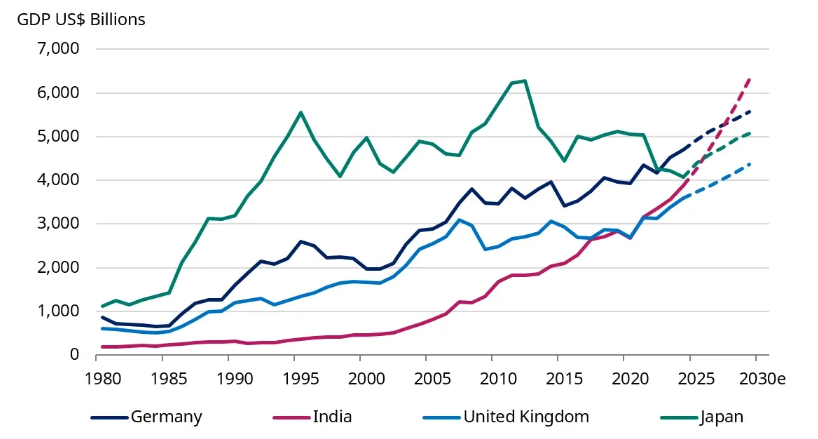

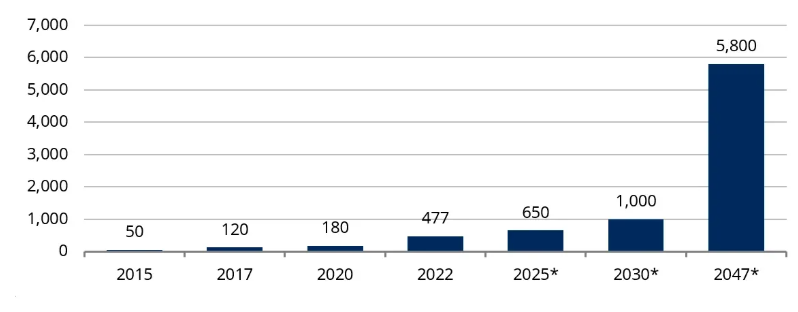

India’s economy has been on an incredible run. The IMF says it’s just a year away from overtaking Japan to become the world’s fourth-largest economy — right behind the US, China, and Germany. And by 2047, it could be a $35 trillion economy, contributing a hefty 20% to global growth!

India surpassed the UK to become the fifth-biggest economy last year

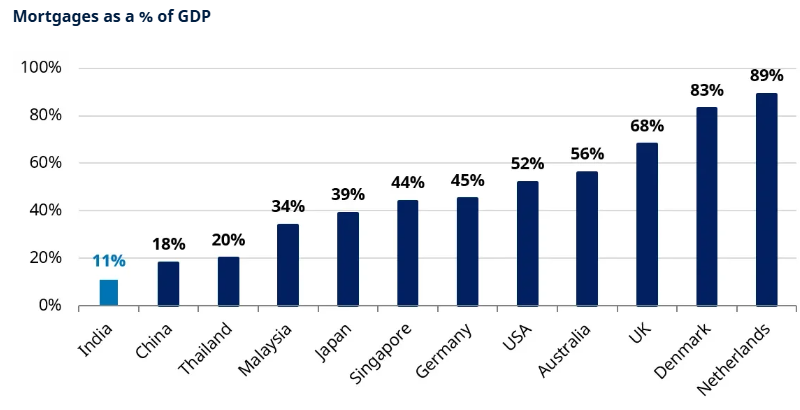

We see many long-term opportunities. In housing, for example, India’s mortgage penetration as a percentage of GDP is growing from a very low base.

One of the main pinch points is the consumer’s ability to obtain a mortgage while some housing developers have limited ability to borrow to build. However, financial institutions such as HDFC, which is at the back end of integrating its acquisition of its sister company, is now in a position to satisfy this demand.

India real estate market is expected to grow 9x over the next two decades

Market size (2015-2022) with projections to 2047 (US$ billions)

Investing successfully

While the growth paradigm has been dominated by Big Tech over the past few years, the opportunity set is, in reality, much broader.

The start of this year is unlikely to be “business as usual”, and it feels right to expect elevated volatility in policy and politics over the months ahead. While there are certainly a lot of moving pieces with little clarity, our message is a familiar one: stay invested and maintain a risk-aware approach. When faced with market gyrations or geopolitical uncertainty, history has taught us that the biggest mistake investors can make is to retreat to the sidelines. If you know your companies well, believe in the management, and are comfortable with their tailwinds for growth, don’t panic – successful investing is a long-term endeavour.

“Your future hasn’t been written yet. No one’s has. Your future is whatever you make it. So make it a good one.”

Doc Brown, Back to the Future Part III

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.