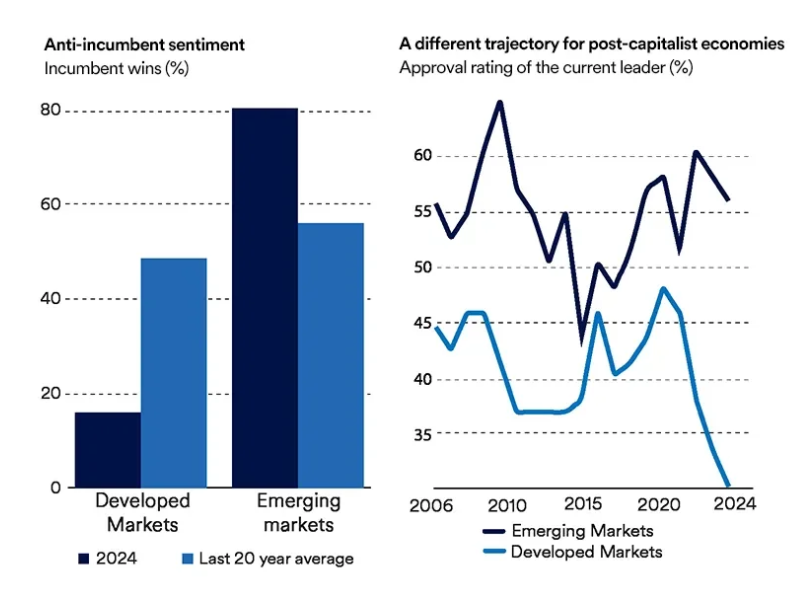

2024 saw one of the biggest global power shifts in recent history, with more people voting than ever before. In a year of elections across the globe, there was one common thread: change. Sitting parties on both the left and right got bulldozed in the name of a fresh start. This was particularly true for developed nations (see the charts below). And the elections haven’t stopped yet. In 2025, voters in Canada, Germany, Australia, Chile, the Philippines, Ecuador and more will head to the ballots.

There are many reasons that vary across geographies for the anti-incumbent wave, but many believe that it reflects a longrunning trend in markets. As Johanna Kyrklund, Schroders’ Chief Investment Officer, has said: “The post-Global Financial Crisis environment of tight fiscal policy, zero interest rates and liberalised global trade was not working for the average person in the West, leading to support for more populist policies.”

The inflation of the last few years may have been the final straw for many voters. Cultural factors also have been at play too. Interestingly, emerging markets appear far more supportive of incumbent parties and leaders than developed markets.

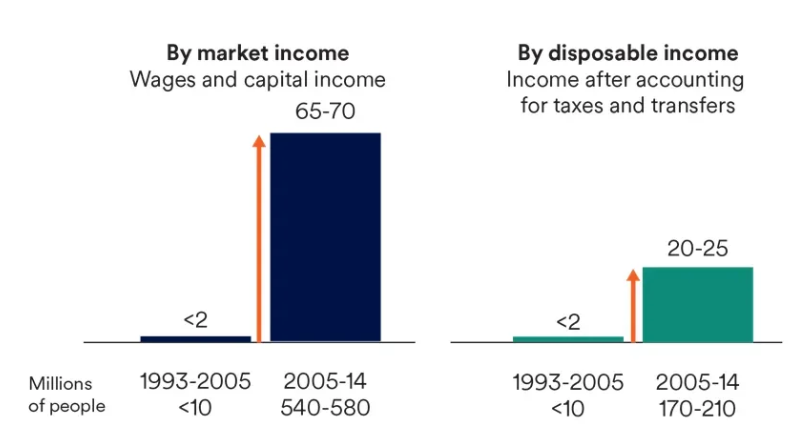

A greater share of households have seen their earnings stagnate

Share of households with flat or falling incomes1 (%)

Source: McKinsey Global Institute analysis. [1] Population-weighted average of 25 countries extrapolated from six country deep dives, for each country we use the latest year the data are available. France (2021), Italy (2021 market incomes, 2014 disposable incomes), the Netherlands (2014), Sweden (2013), United Kingdom (2014), and United States (2013). The base year for France is 1996 and for Sweden is 1995.

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.